10 tips for Outsourcing for MNOs – and why ROCCO does its Benchmarking reports

Written by ROCCO CEO Jason Bryan.

“What we ever hope to do with ease, we must first learn to do with diligence.” – Johnson

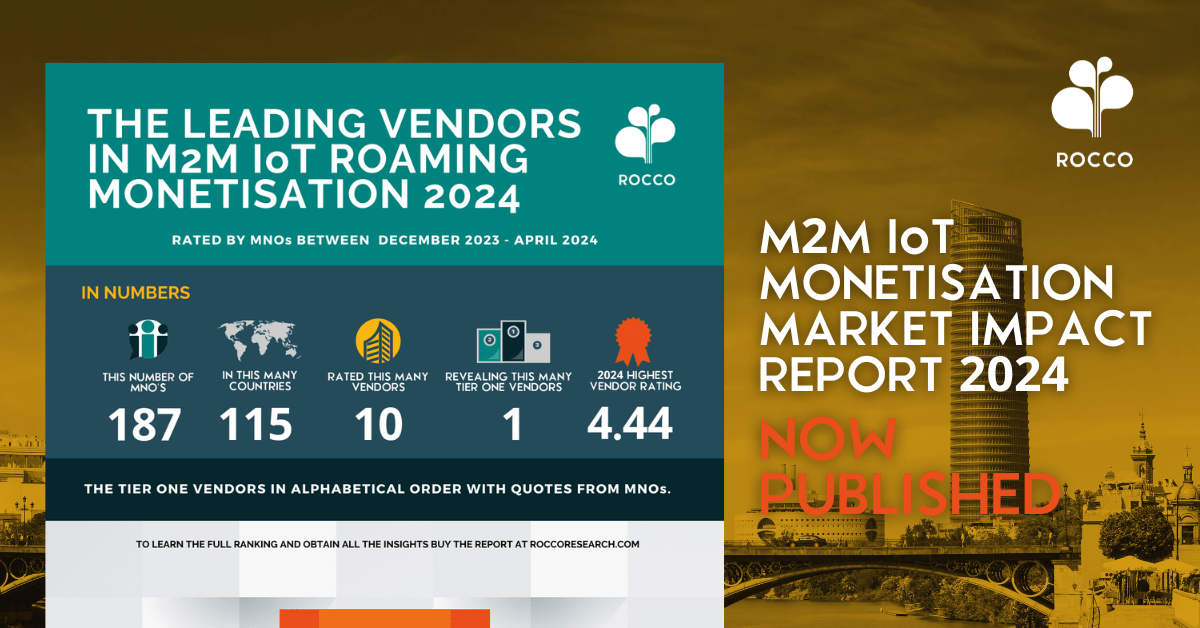

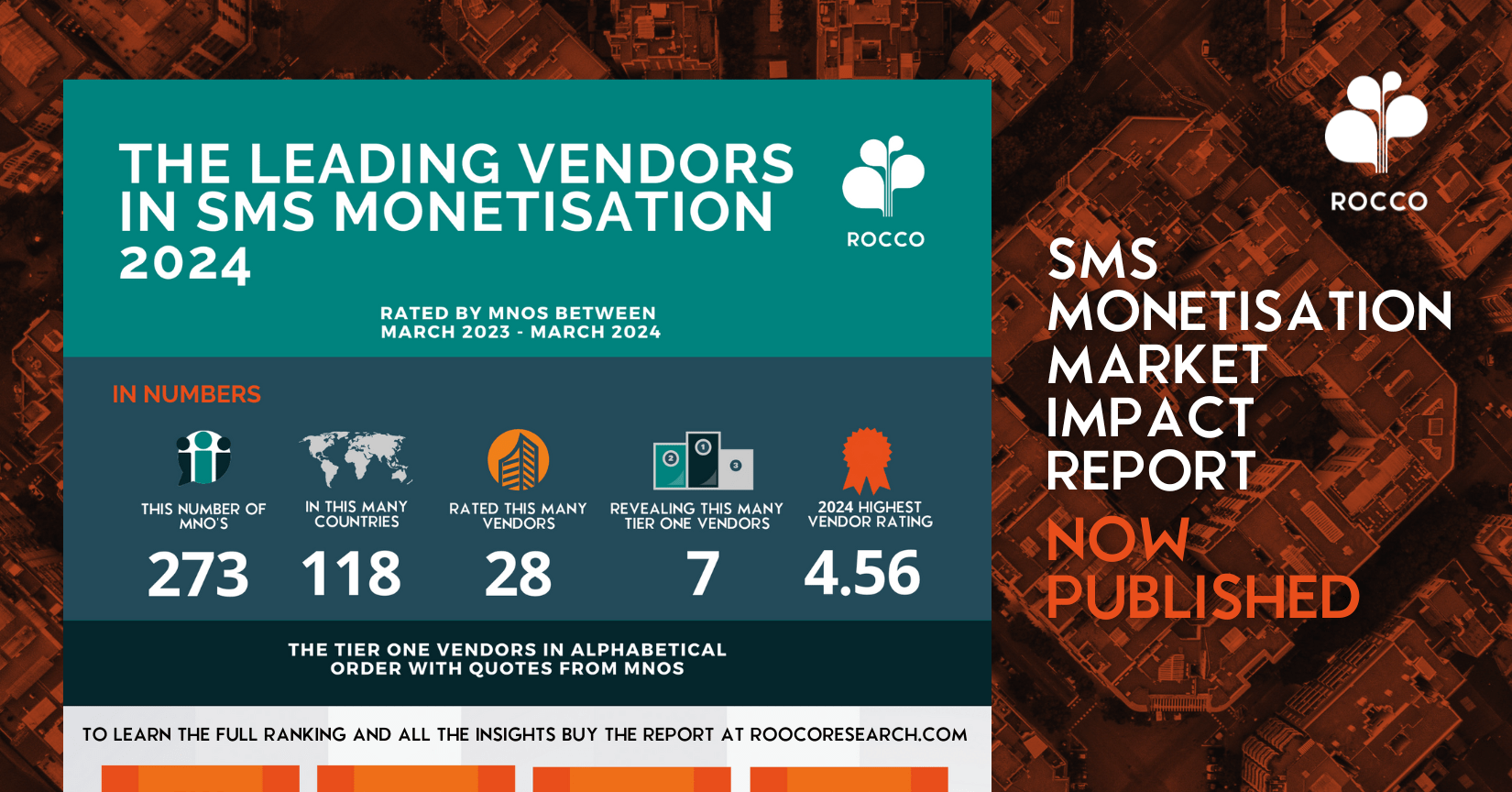

Back in 2010, while working for Vodafone, I took an idea to the BARG leadership team (now WAS) for an operator compliancy model, it was a bit beleaguered and difficult to deliver but it worked on some level to get Operators to think about compliancy. A few months later MNOs raised the need to get some kind of similar compliance for vendors. They’d been having a lot of problems and something had to be done. So, in 2012 to help MNOs find good vendors, ROCCO started to provide Vendor Performance reports. The methodology was independent, simple and complete. MNOs would rate Vendors on a number of KPIs (quite common in other industries but not yet found in our corner of telecoms). No absolute truth of course, but reliable guidance for MNOs about what other MNO’s thought.

As time went on we got to understand the industry better and better and they were not all good discoveries. In 2015 a student wrote to me explaining that they were doing a project on A2P SMS and wondered if ROCCO would be willing to share our latest report with him. My first instinct was of course yes. The report had taken a lot of effort to create and it was hard to communicate the challenge of getting hundreds of global MNOs to respond to our research request, but I thought, if we can encourage a student to get enthusiastic about our industry it would be worth it. The student sent us the name of a University professor they were studying under and even his phone number and it all seemed legitimate. Then, the ROCCO team thought we would check them out on LinkedIn and we discovered that actually they had not been a student for several years. Their current role was as the new head of marketing in quite a prestigious A2P SMS vendor in the USA. As a young company trying to make it in the big world of telecoms we were naturally disappointed. Kudos for their creativity, but also wondering why any brand wasn’t willing to invest in research which basically could help them understand the market and improve their performance. I noted this episode as important lesson in working with industry vendors.

As time went on we got to understand the industry better and better and they were not all good discoveries. In 2015 a student wrote to me explaining that they were doing a project on A2P SMS and wondered if ROCCO would be willing to share our latest report with him. My first instinct was of course yes. The report had taken a lot of effort to create and it was hard to communicate the challenge of getting hundreds of global MNOs to respond to our research request, but I thought, if we can encourage a student to get enthusiastic about our industry it would be worth it. The student sent us the name of a University professor they were studying under and even his phone number and it all seemed legitimate. Then, the ROCCO team thought we would check them out on LinkedIn and we discovered that actually they had not been a student for several years. Their current role was as the new head of marketing in quite a prestigious A2P SMS vendor in the USA. As a young company trying to make it in the big world of telecoms we were naturally disappointed. Kudos for their creativity, but also wondering why any brand wasn’t willing to invest in research which basically could help them understand the market and improve their performance. I noted this episode as important lesson in working with industry vendors.

A year later, our reports had become popular with MNOs, enterprises and investment companies. Any vendor appearing in tier one position in our reports were typically next in-line to be acquired by investors or their competitors.

It was a tick in the box for us, because we came from MNOs, our very essence was in helping people in MNOs like us who had the unenviable task of choosing vendors in what was a very troubling marketplace. It was then we started to know a lot about what acquisitions are happening in the industry before they happened because investment or holding companies were investing in our research. MNOs would come up to us at conferences and thank us. The difference we had hoped to make, was emerging.

Around about 2017, we got a call from a client, a senior director in a vendor who said how impressed he was with the research work we were doing. He’d bought our reports and they were used in his board room meetings as competitor analysis. We were flattered by the praise and accomplishments, for a few minutes at least. However, then the situation took a different turn. He asked us how much it would cost for his company to become a tier one company in the report. It was quite a disturbing realisation. You mean this is something research companies did? How could anyone ever find value as a vendor, customer or as a research company in vendors buying positions in reports? It made us realise why our reports had been popular, because the problem of vendor selection was a very difficult challenge in the industry.

At the end I told the director that we didn’t do that at ROCCO, but that MNOs and Enterprises came to us for real recommendations, (which vendors were trustworthy, honest and reliable). I also informed them that ROCCO worked on RFQ projects, so I was in a position to recommend vendors from our reports. I never heard from the company again and subsequently they were acquired by another vendor.

The message here is that coming into this corner of telecoms, it’s so important to understand the industry dynamics. One of the biggest problems for an MNO is the massive project of changing vendor when the company is not delivering on the MNOs expectations. MNOs may stay with vendors for years despite being unhappy with them (we track their outsourcing journey in our research and ask when they expect to change vendor). When I was chairing groups in the GSMA, some PRDS were even developed to help with these kind of migrations. When there’s a major problem and a vendor sends 15 resources to a meeting with your team, you know they’re pretty keen to keep you (this happened to me when I was in Vodafone and the whole team wondered, whose paying for all that expense?).

Sometimes, as we saw in a 2018 report, all the vendors in a specific sector were underperforming and MNOs reported this to us globally. So there were no tier ones in our research at all. In this scenario, the MNO knows that moving vendor won’t make any difference, but they are still unsatisfied with what they are getting.

On balance, vendors in our industry face a lot of challenges too. The ever increasing demand to lower their pricing to MNOs looking for discounts year after year. How can a person with a secure job working in an MNO really understand what it is to be a vendor in this market. So when they ask for discounts on discounts or services for free they generally don’t know the real impacts on the vendors ability to perform to their expectations. I’ve had vendors come to me saying that their profit margin is so low they don’t know how they will survive and this was before the pandemic. How can vendors invest in research and development and improve services when they have less and less revenue to work with, always worried about their MNO customer churning.

Is it surprising then that some vendors try to make a success based on fake rankings? Wouldn’t it serve them better to gain credibility solving the industries problems? MNOs love to talk and most marketing in this industry is happening from the recommendations of MNOs to other MNOs virally at conferences. MNOs are smart, most people working for them have stayed in this industry for many years and know all these scenarios. At the end of the day, it comes down to a vendors authenticity and the feeling you have that what they are doing they feel passionate about.

Some vendors do amazing work, they have the tenacity to uncover what MNOs really want and we have gotten to recognise them thanks to MNOs support for our research. Most MNOs make steady incremental innovations every year and take a lot of pride in what they do. In January this year we highlighted some of the best vendors according to MNOs in our annual report.

Today, the marketplace has some pretty amazing vendors. Some of them, are more specialist and don’t even have that many customers, because to some MNOs the number of other clients you have doesn’t matter at all. However, the moral of the story is for everyone to be vigilant and do your homework if you want to find them. It’s worth every extra minute it takes to make the right decision about outsourcing.

Now for a few tips we’ve picked up on to help you navigate the treacherous waters of outsourcing in our industry:

-

Speak to other customers that the vendor has and learn from their experience for every service you take from the vendor.

-

Try also to understand the reasons why MNOs who are no longer clients, stopped using the service and why.

-

Due financial diligence, as some companies are unstable right now, make sure to understand the success of the company, its leadership and what are its resourcing plans in what locations.

-

Know well your requirements for each service you want to take and try and ask another MNO if you think they might have additional requirements which might be useful to you.

-

Consider what happens if your business grows or declines, what happens in Force majeure scenarios like a Pandemic, or if you are acquired by another MNO.

-

Ask if they are compliant to GSMA standards and seek evidence of that.

-

Ask to speak to everyone, not only to a sales or account manager but also to a technical member of staff to ascertain whether the brand messaging truly runs through the company.

-

Assess a few vendors and make a pros and cons list not only based on price, because in the end inefficiency costs money too.

-

Trials work, if you can take them on a trial basis do it, especially if you are in a group and one of the group can assess their experience.

-

Ask anything. Don’t feel that you can’t ask all these questions even of vendors who are recommended to you – in the end the vendor is used to it.

Best of luck with your outsourcing. Let us know how it goes and if this advice helped at all.